What Is The Gift Tax Amount For 2024

What Is The Gift Tax Amount For 2024. If you give more than the annual gift tax limit, you may have to file a gift tax return, but this does not necessarily mean that you'll owe. What is the 2023 and 2024 gift tax limit?

The gift tax exemption for 2024 is $18,000 per gift recipient. Federal gift tax exemption 2024.

The Gift Tax Rate Ranges From 18% To 40%, Depending On The Amount Of The Gift And Your Tax Bracket.

There's no limit on the number of individual gifts that can be.

For 2024, The Annual Gift Tax Limit Is $18,000.

The annual gift tax exclusion allows individuals to give up to a certain amount of money to another.

For 2024, The Annual Gift Tax Exclusion Is $18,000, Meaning A Person Can Give Up To $18,000 To As Many People As He Or She Wants Without Having To Pay Any Taxes On The Gifts.

Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, You can use the gift tax exclusion to give away a set amount every year, $18,000 in 2024 ($17,000 in 2023; The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Gift Tax Limit 2022 Calculation, Filing, and How to Avoid Gift Tax, The amount by which you exceeded the annual gift tax exclusion will also be deducted from your lifetime gift tax exemption and your federal estate tax exemption. In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in 2025).

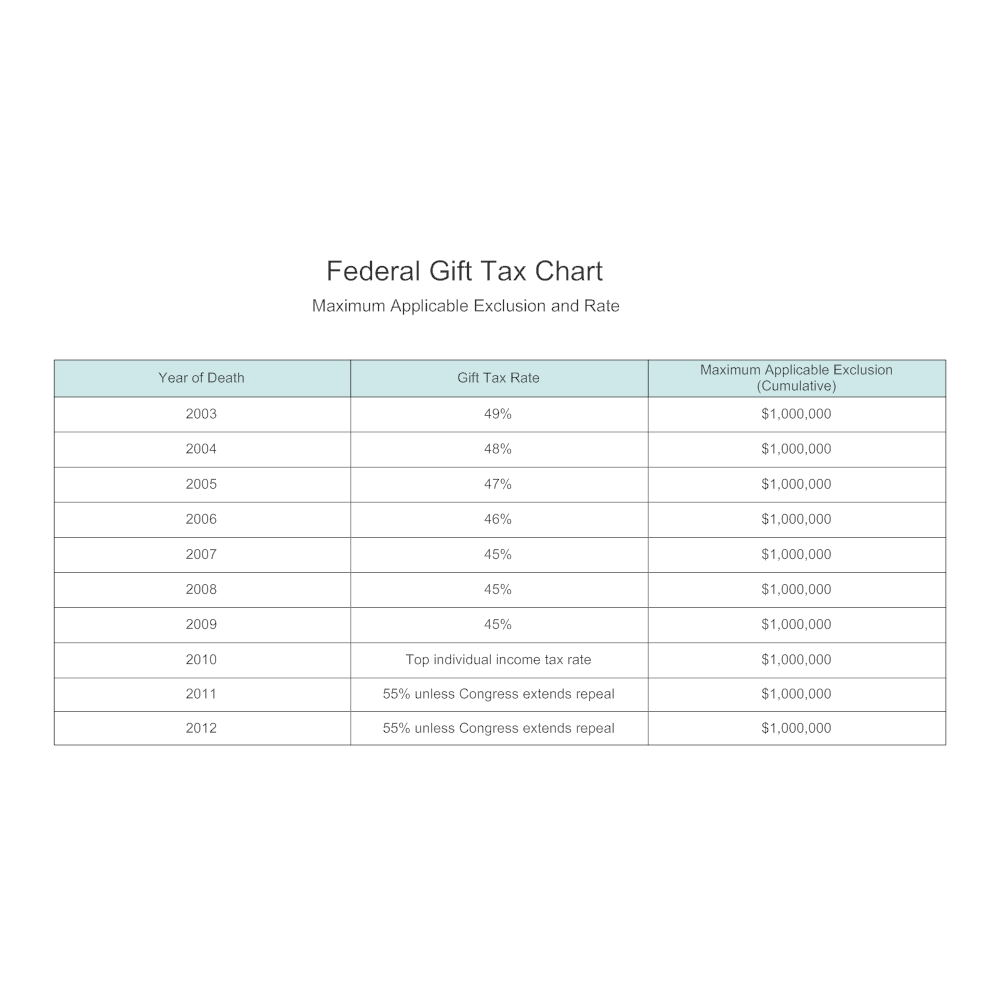

Source: www.smartdraw.com

Source: www.smartdraw.com

Federal Gift Tax Chart, The $18,000 amount is how much each person can give to any other person each year without the gift being treated as a taxable gift. If you give more than the annual gift tax limit, you may have to file a gift tax return, but this does not necessarily mean that you'll owe.

Source: www.forbes.com

Source: www.forbes.com

What Is The Gift Tax Rate? Forbes Advisor, The $18,000 amount is how much each person can give to any other person each year without the gift being treated as a taxable gift. Gift tax due = (taxable amount x applicable rate) + (taxable.

Source: www.expensivity.com

Source: www.expensivity.com

Everything You Need To Know About The Gift Tax Expensivity, The gift tax exemption for 2024 is $18,000 per gift recipient. For example, a man could give $18,000 to each of his 10 grandchildren this.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Bottom line the lifetime gift tax. For example, a man could give $18,000 to each of his 10 grandchildren this.

Source: apeopleschoice.com

Source: apeopleschoice.com

Understanding Federal Estate and Gift Tax Rates A People's Choice, This gives us a total gift tax amount of $2,400. In 2024, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Source: www.czepigalaw.com

Source: www.czepigalaw.com

Gift Tax 101 What You Need to Know — Connecticut Estate Planning, But remember, these taxes only apply after you exhaust your $12.29 million. The $18,000 amount is how much each person can give to any other person each year without the gift being treated as a taxable gift.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Know about gift tax, how are gifts taxed and when are gifts exempted from income tax. The gift tax exemption for 2024 is $18,000 per gift recipient.

Source: willabellawleola.pages.dev

Source: willabellawleola.pages.dev

How Much Is The Gift Tax Exclusion For 2024 Roana Christel, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2024, estimated to be $19,000 in 2025). What is the 2023 and 2024 gift tax limit?

What Is The 2023 And 2024 Gift Tax Limit?

For a married couple, the exclusion.

Instead, A Gift Is Taxed Only After You Exceed Your Lifetime Estate And Gift Exemption, Which In 2024 Is $13.61 Million For Individuals And $27.22 Million For Married.

$17,000 in 2023 per recipient.